We’ve seen the world grapple with inflation, and we’ve also felt it strongly as prices of basic and essential goods have increased at unprecedented levels.

With this, Euroasia aims to help consumers make easier yet smarter decisions with their purchases by conducting a Price Survey showing the cheapest supermarket retailer. The said Price survey will thus be guided by the following principles:

- The Price Survey shall be conducted on a bi-monthly basis

- An average of three retailers shall be surveyed each round

- An average of 30 -70 items available across all retailers being surveyed shall be canvassed

- Participants are ranked based on the total price of all comparable items (SKUs available across all retailers)

Retailers Surveyed

Items Surveyed

76 items were surveyed, 63 of which are available across all retailers, which are as follows:

- Pancit Canton Kalamansi 80g

- Pancit Canton Chilimansi 80g

- Pancit Canton Sweet and Spicy 80g

- Lucky Me Beef 55g

- Lucky Me Chicken 55g

- Bear Brand Powder135g

- Milo 300g

- Mang Tomas Regular 100g

- Ufc Banana Catsup 320g

- Ufc Banana Catsup 200g

- Lorins (Pouch) 150ml

- Datu Puti Vinegar 200ml

- Datu Puti Soy Sauce 200ml

- DM Four Seasons Tetra 1L

- Absolute Water 500ml

- Star Margarine Classic

- Magnolia Quickmelt Cheese 165g

- Kraft Eden Filled Cheese 160g

- Yakult 80ml*5

- 555 Sardines TomSauce 155g

- Mega Sardines in tomato sauce chilli 155g

- Century Tuna Flakes in Oil Hot and Spicy 180g

- Young’s Town Green 155g

- Argentina CB 150g

- Argentina CB 175g

- Purefoods Corned Beef ChiliGarrlic 150g

- Purefoods Corned Beef 380g

- Purefoods Corned Beef 210g

- Maling B2 Chicken Lencheon Meat

- TulipJamonillaLuncheonMeat RedSodium

- San Marino Corned Tuna 150g

- San Marino Corned Tuna Chili150g

- Rebisco Hansel Crackers Plain *10

- Sky Flakes Singles 25g*24

- Rebisco Hansel Flvr Mocha

- Rebisco Hansel Milk Sandwich

- LS Cheesecake Original 30g*10

- Maxx Honey Lemon *50

- Angel Evaporated Filled Milk 410ml

- AlaskaClassic Sweetened Condenesed Milk 300ml

- Alaska Evaporated Filled Milk 370ml

- Nestle All Purpose Cream 250ml

- Maggi Magic Sarap 55g

- Knorr Cube Chicken 120g

- Knorr Cube Pork 120g

- Knor Cube Beef 60g

- Quaker Instant Oats 200g

- Knorr Crab and Corn 55-60G

- Knorr Crab and Corn 40g

- Knorr Liquid Seasoning Original 250ml

- Mama Sitas Oyster Sauce 405g/14oz

- Iodized Salt McCormick 500g

- Purefood Hotdog Regular 1kg

- Ladies Choice Mayonaise Doy 470ml

- Safeguard Bar Lemon 175g

- Creamsilk Defense 12ml*12

- Head&Shoulder Menthol 12ml*12

- Sunsilk 13-15ml*12

- Downy fabcon sunrise fresh 24ml*6

- Coca-cola Regular 1.5L

- Magnolia DariCreme ButterMilk 200g

- Magnolia DariCreme Classic 200g

- Emborg Butter Salted 200g

- Maya All Purpose Flour 400g

- Maya Hot Cake Original 500g

- Nestle Fresh Milk 1L

- Alfonso Light 1L

- Gin Frasquito 350ml

- Antonov Vodka 700ml

- San Miguel Light Can 330ml

- San Miguel Pale Pilsen Can 330ml

- Tang Pineapple 19g

- Heineken Beer Can 330ml

- Heineken Silver Can 330ml

- Pineapple Slices 227g

- Reno Liver Spread 85g

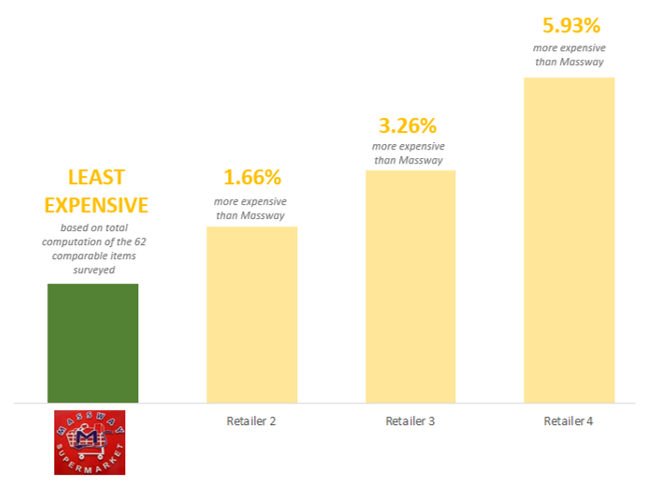

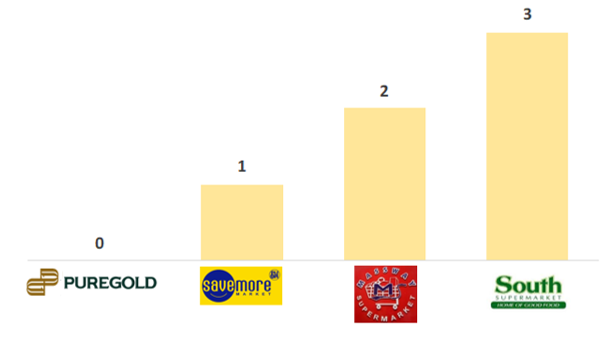

Result of the Survey

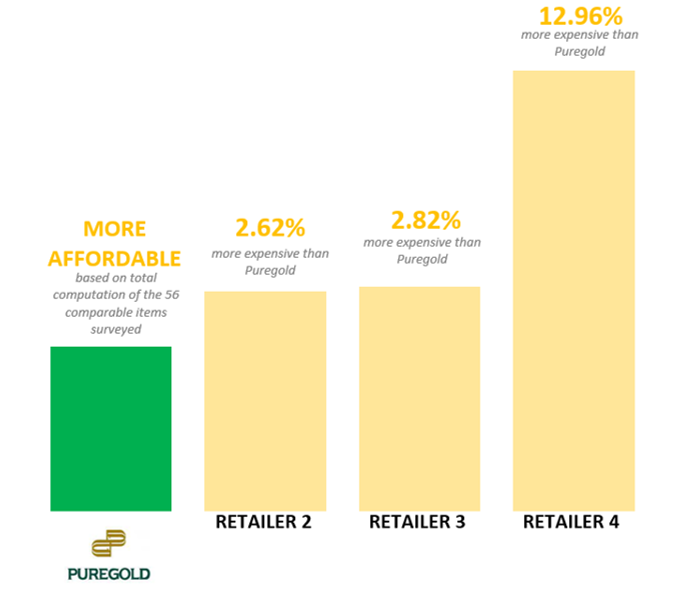

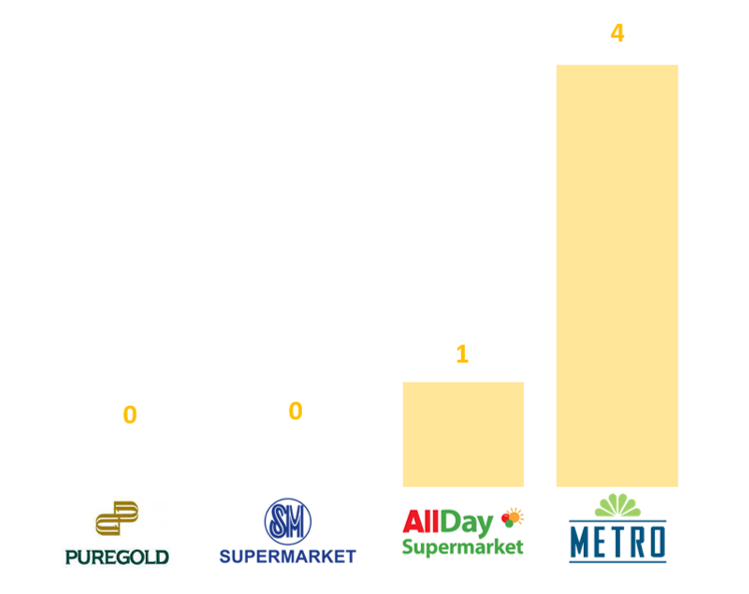

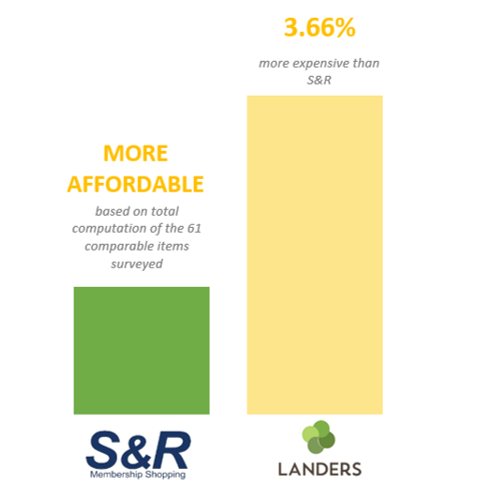

In terms of Pricing

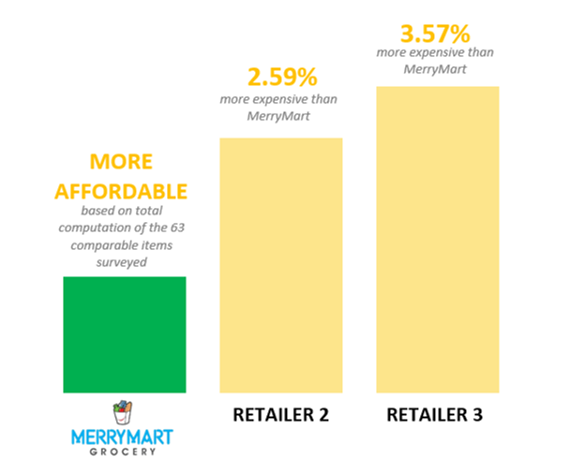

The winner of this week’s price survey is MerryMart Grocery, which excelled in terms of pricing among the three retailers surveyed. With a total of 63 SKUs out of 76, MerryMart Grocery outperformed the competition. It is followed by Retailer 2, which is 2.59% more expensive, and Retailer 3, which is 3.57% more expensive.

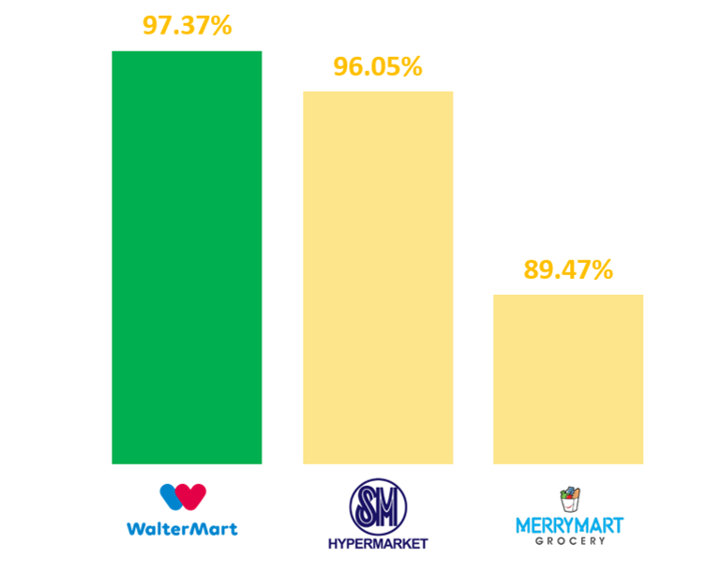

In terms of Product Availability

In terms of availability, Waltermart bested the other two retailers with 97.37% availability out of the 76 SKUs surveyed. It’s followed closely by SM Hypermarket at 96.05%. Despite winning in terms of price, MerryMart Grocery has the lowest rate of availability at 89.47%.