Original Article: https://www.euromonitor.com/article/what-are-the-top-consumer-trends-in-2024

The Pennsylvania-based donut and coffee chain has partnered with Bravo Foods Corp to open 25 outlets across the Philippines within six years – its largest international franchise agreement to-date.

Duck Donuts will enter the Philippines this year after signing its largest international franchise agreement to-date.

Local franchisee Bravo Foods Corp will open its first Duck Donuts in Makati – a key financial and retail hub in the Metro Manila region – in the second quarter of 2024. Bravo Foods Corp will then seek to open 25 sites by 2030.

“We believe that the warmth and uniqueness of Duck Donuts will resonate with the Filipino community. We are excited to embark on this journey of sweet success in partnership with Bert Bravo and leverage his knowledge of the market and industry as we begin to introduce Duck Donuts throughout the country of the Philippines,” said Betsy Hamm, CEO, Duck Donuts.

“I saw the potential of Duck Donuts when I first heard about it from my colleagues in California. We are excited to bring the unique, customisable donuts to our country,” added Bert Bravo, CEO, Bravo Foods Corp.

Duck Donuts currently operates 145 stores across 25 US states alongside international sites in Canada, Puerto Rico, Thailand, Egypt, Pakistan and Qatar. The franchise donut and coffee chain expects to open 10 new international stores this year and also has franchise agreements to launch in Aruba, Bonaire and Curaçao, Australia and the UK.

Jollibee Food Corporation (JFC) has opened the first Common Man Coffee Roasters (CMCR) in the Philippines at the Ayala Triangle Gardens in Makati City.

Founded in 2013, CMCR is a Singaporean brunch-focused café chain with eight outlets across its domestic market and Malaysia. CMCR also roasts specialty coffee and provides barista training in Singapore and Malaysia via its Coffee Barista Academy.

The Makati City store features an in-house roastery and will offer a premium specialty coffee menu, including slow brew filter coffee priced from PHP220 ($3.90). Additionally, cappuccino and flat white are priced at PHP180 ($3.20) and CMCR’s signature Nitro Honey Oat Latte at PHP250 ($4.47).

Market leader Dunkin’, which has 800 outlets in the Philippines, retails cappuccino at PHP90 ($1.60) while premium-focused Starbucks prices the same beverage at PHP160 ($2.80).

The chain’s launch in the Philippines follows a joint venture agreement between JFC and Singapore-based Food Collective Pte. Ltd. which also includes a deal to bring 16-store Tiong Bahru Bakery to the country.

“We’re excited to bring the Common Man Coffee Roasters in the country and give the community an elevated café experience. Common Man’s consciously sourced coffee and numerous deliciously healthy brunch options contribute to this experience and help fulfill our mission of spreading the joy of eating to everyone,” said Ernesto Tanmantiong, CEO, JFC.

JFC operates more than 6,500 outlets globally across its 16 food and beverage brands, including its eponymous fast-food restaurant chain Jollibee, coffee chains Highlands Coffee and The Coffee Bean & Tea Leaf, alongside bubble tea chain Milksha. The Filipino fast-food giant said launching CMCR in the Philippines forms part of its ‘aggressive growth plans’ for 2024 as it seeks to become one of the five largest restaurant companies in the world.

THE Philippines ranked first in retail e-commerce growth in 2022 among Southeast Asian countries, posting a 25.9-percent growth, according to an Asian Development Bank (ADB) report.

The ADB report, published in November 2023 with the title “E-Commerce Evolution in Asia and the Pacific: Opportunities and Challenges,” noted that although the e-commerce ecosystem in the Southeast Asian subregion is still “nascent,” the market has been growing rapidly and outpaces the rest of its Asian neighboring countries.

Citing a 2022 report by Cramer-Flood, ADB said the subregion’s growth of 20.6 percent in retail e-commerce in 2022 “stands out” among all other economies and regions globally.

In addition, it noted that only four economies reported faster growth rates than the combined figure of Southeast Asia. Two of these, however, still belong in the subregion, namely, the Philippines and Indonesia, ADB said.

“The Philippines, on the other hand, ranks first in retail e-commerce growth in 2022, posting 25.9-percent growth.

Five economies within the region—Indonesia, Malaysia, the Philippines, Thailand, and Viet Nam—will rank among the top 10 markets worldwide measured by retail e-commerce sales growth by the end of 2022,” ADB noted as it cited the 2022 Cramer-Flood report.

he multilateral institution pointed out that the subregion’s rapid growth is “largely driven” by a spike in digital consumers since the pandemic began.

In fact, ADB said according to Meta, Facebook estimates that since the start of the pandemic, 70 million people in Southeast Asia have become digital consumers, with about 30 million joining those ranks from 2020 to 2021 alone.

Further, a 2021 Google report noted that the aggregate internet penetration in Southeast Asia grew to 75 percent by the end of 2021, ADB said.

“In 2022, there were about 516.5 million internet users in Southeast Asia alone,” ADB noted, citing Statista.

Meanwhile, in terms of retail spending, ADB noted that Singapore continues to pose the highest per capita e-commerce spending at $772.25 per capita in 2022, from only $389.8 per capita in 2019 or pre-COVID 19 pandemic.

This, ADB noted, is almost three times the e-commerce spending in Thailand, which is at $273.4 per capita. Meanwhile, exponential growth from prepandemic levels is seen in Malaysia, whose spending per capita increased from $112 in 2019 to $200 per capita in 2022.

For Indonesia, its spending per capita soared from $66 per capita in 2019 to $207 per capita in 2021 while the Philippines, at $60.3 per capita and Viet Nam, posting $153 per capita, lagged in 2022, the ADB report noted

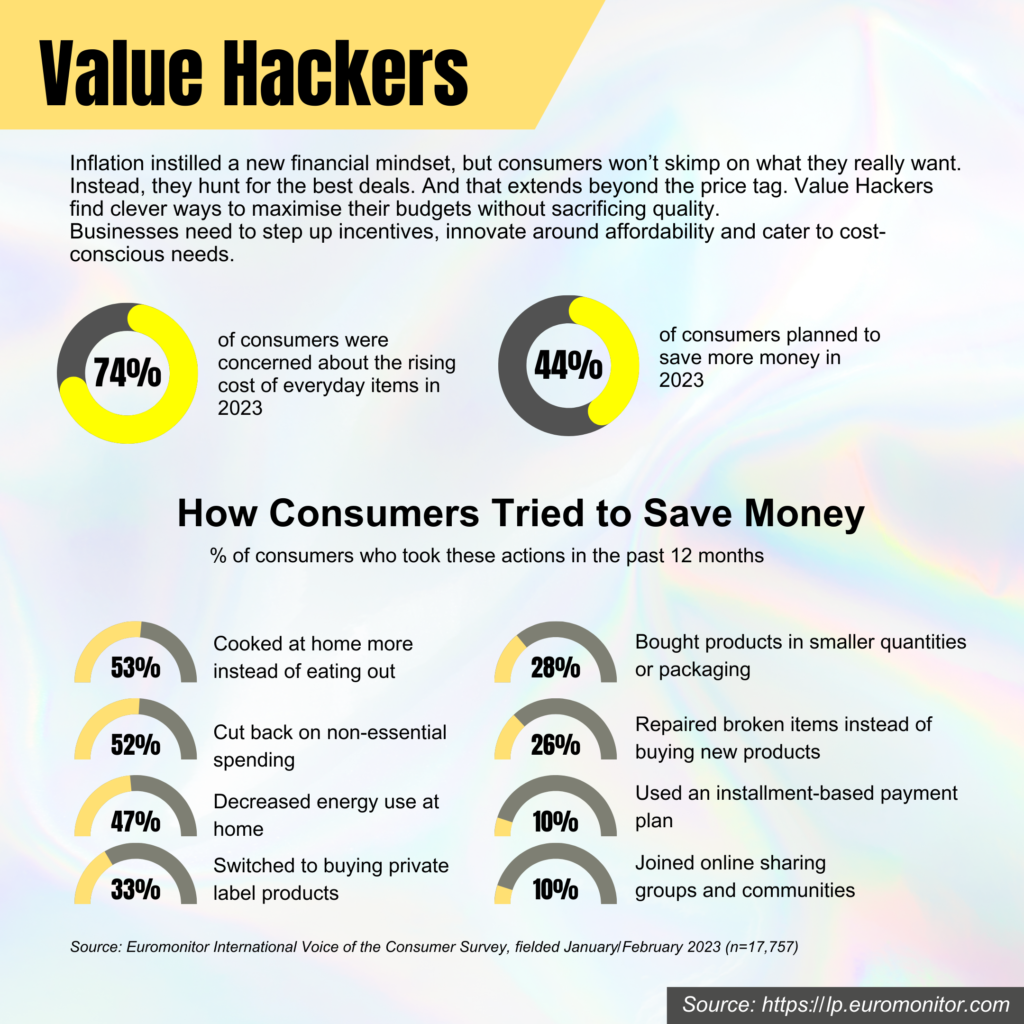

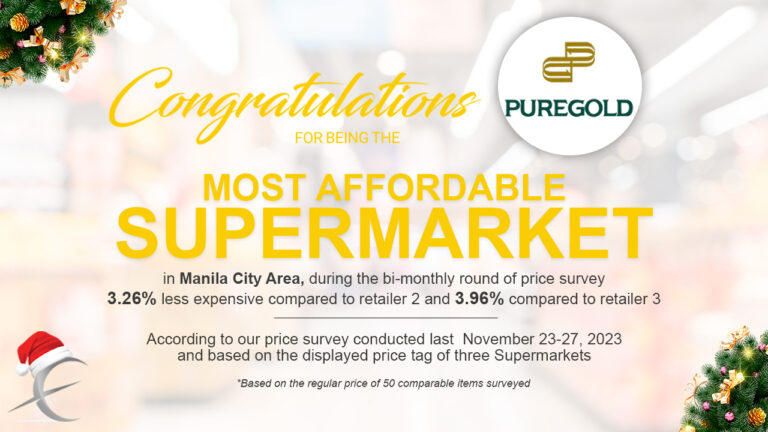

Prices of basic and essential goods have been rising during times of inflation. The substantial impact of this situation concerns a growing number of individuals, which leads them to become more budget-conscious consumers by looking for affordable alternatives.

With this in mind, EuroAsia Research Experts conducted a Price Survey to identify the cheapest supermarket retailer to help you make simple yet smarter decisions with your purchases.

The Price Survey is hereby guided by the following principles:

The following 55 items were surveyed, 50 of which are available at all retailers:

Price plays an important role in consumer buying decisions. Consumers, particularly budget-conscious consumers, are heavily influenced by it, as they often compare the prices of products and choose which option provides the greatest value for their money.

Thus, EuroAsia Research Experts gives you this week’s most affordable supermarket retailer to help you decide!

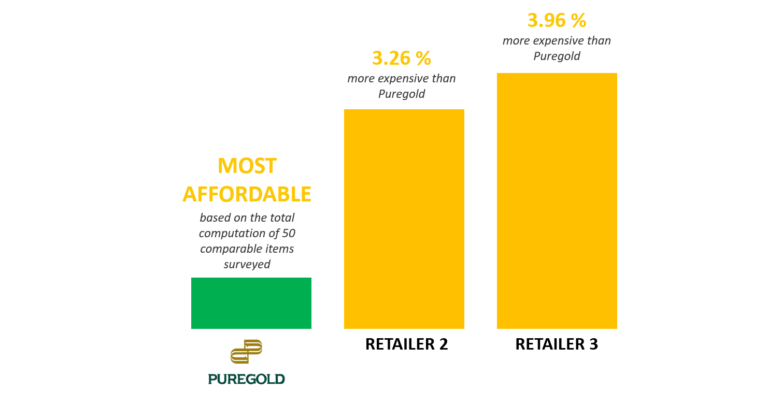

Puregold, not just true to its tagline, “Sa PUREGOLD, Always Panalo!” but also emerged as the go-to retail brand for the majority of Filipinos in 2022 according to Kantar, was hailed again as the most affordable supermarket among the other two retailers for this week! Retailer 2 is 3.26% more expensive, followed by Retailer 3, which is 3.96% more expensive than Puregold.

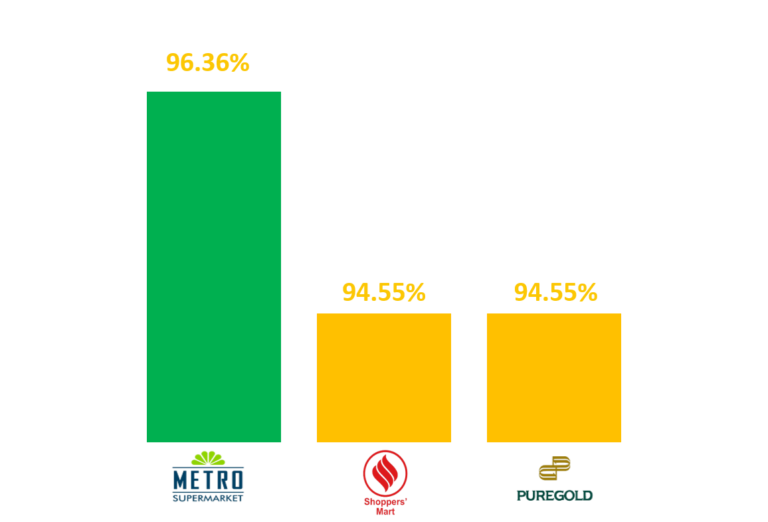

Metro Supermarket, with 96.36% of the 55 SKUs surveyed compared to the other two retailers, excelled in terms of product availability! On the other hand, Shoppers’ Mart and Puregold battled for the next spot, with both having 94.55% of the 55 SKUs surveyed.

EuroAsia Research Experts is a valuable resource that offers a price survey, providing consumers with the latest insights from supermarkets and retailers. This information is designed to assist individuals in making well-informed purchasing decisions.

Whether you are looking to compare prices between different supermarkets or simply want to stay updated on the latest pricing information, EuroAsia Research Experts is here to help. So, the next time you are in need of guidance for your shopping needs, turn to EuroAsia Research Expertsfor the most up-to-date insights which will make you purchase with confidence.

Filipinos have increased their budgets for holiday shopping in online channels given the convenience, exclusive discounts, and range of offerings, according to marketing technology provider InMobi.

The InMobi 2023 Holiday Retail Guide for Advertisers showed that 57% of local holiday shoppers have increased their budgets for online shopping, yet it noted 43% have less than P10,000 in budget.

It added that 35% have a budget of P10,000 to P25,000, 13% can spend P25,000 to P50,000, and 5% eye running through over P50,000.

“They pick mobile for its convenience and physical stores for tangible product experiences and assurances,” InMobi said on holiday deal sources.

On one hand, respondents preferred shopping on mobile due to the convenience of ordering (72%), app-only discounts (60%), and ranges (47%), InMobi noted.

These included purchases in clothing and accessories, health and beauty, hobbies, and gadgets, it added.

On the other hand, in-store shoppers cited getting to see or try the product (96%), lesser chances of buying the wrong product (82%), and in-store offers (60%) as their top reasons, InMobi said.

It mentioned home appliances and improvement, gadgets, gift packs, and holiday-focused groceries as top in-store purchases.

InMobi noted peak shopping activities in double-digit festivals, such as 11.11 and 12.12, as opportunities for shoppers to explore and purchase, which brands must take advantage of.

“It starts with being present with those who have already started exploring,” it said on tips for brands. “With mobile emerging as the top shopping channel, it is important to create experiences that engage the holiday shopper at every touchpoint.”

InMobi suggested online retailers leverage technology, such as interactive camera filters and personalized mobile-first experiences, to engage with shoppers.

“Understand them and decode their online and offline behavior,” it said. “Evoke engagement throughout their shopping journey by being on the destinations they love.”

“Drive delight with innovative and engaging mobile experiences that inspire action.”

Additionally, the report showed that 55% of Filipino shoppers are category explorers, 38% are brand lovers, and 7% are bargain hunters.

“More men exhibit love for brands, while more women are hunting for the right deals,” it said on holiday shopper personas in the Philippines.

The InMobi 2023 Holiday Retail Guide for Advertisers sampled 1,000 mobile users across the Philippines, Indonesia, and Singapore between Sept. 12 and 18.

Nowadays, the impact of inflation has been felt everywhere, especially on the prices of basic and essential goods, which have been rising. This concerns a growing number of individuals and drives them to become more budget-conscious consumers by looking for affordable alternatives.

With this in mind, EuroAsia Research Experts conducted a Price Survey to determine the cheapest supermarket retailer to help you in making simple yet smarter decisions with your purchases.

The Price Survey is hereby guided by the following principles:

The following 68 items were surveyed, 64 of which are available at all retailers:

Budget-conscious consumers looking for affordable alternatives are highly influenced by price when it comes to their buying decisions. They often compare the prices of products and choose which option provides the greatest value for their money.

With this, EuroAsia Research Experts gives you this week’s most affordable supermarket retailers.

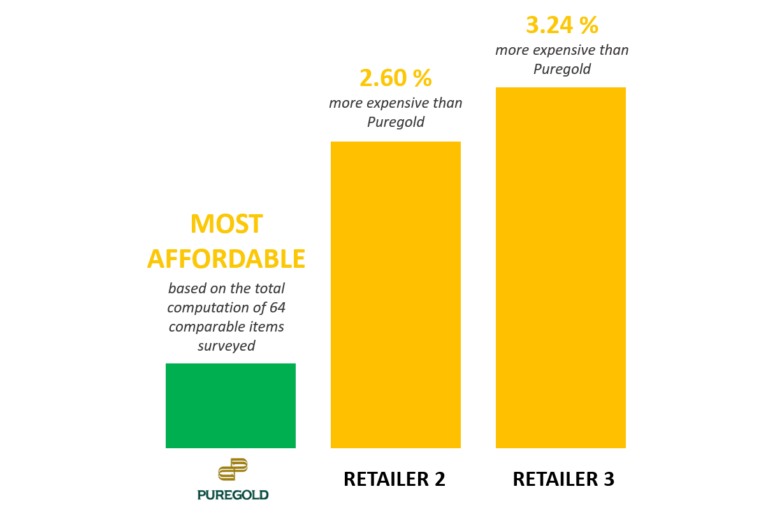

Puregold, best known for its tagline “Sa PUREGOLD, Always Panalo!” won over the two other retailers in terms of pricing with 64 out of 68 SKUs surveyed. Retailer 2 is 2.60 % more expensive, followed by Retailer 3 which is 3.24% more expensive than Puregold.

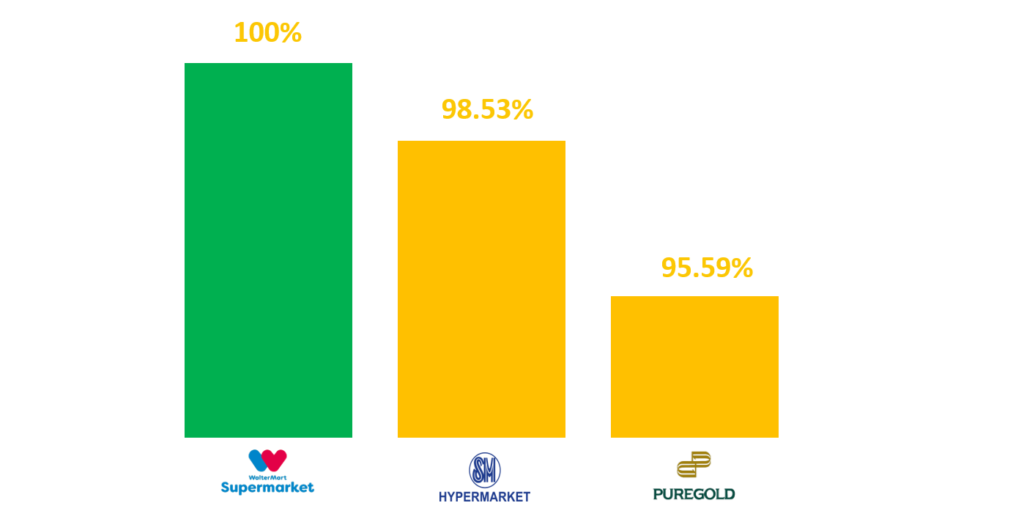

In terms of product availability, WalterMart, with 100% of the products surveyed available, won over the two other retailers! Followed closely by SM Hypermarket, with 98.53% of the 68 SKUs surveyed. However, Puregold, in spite of excelling in terms of price, loses in terms of product availability for only having 95.59% of the products surveyed.

EuroAsia Research Expert is a valuable resource that offers a price survey, providing consumers with the latest insights from supermarkets and retailers. This information is designed to assist individuals in making well-informed purchasing decisions.

Whether you are looking to compare prices between different supermarkets or simply want to stay updated on the latest pricing information, EuroAsia Research Expert is here to help. So, the next time you are in need of guidance for your shopping needs, turn to EuroAsia Research Expert for the most up-to-date insights which will make you purchase with confidence.

Food and beverage (F&B) products dominate the Top 10 Most Chosen FMCG (Fast-Moving Consumer Goods) Brands by Filipinos in 2022, according to an analysis by Kantar, world’s leading data, insights and consulting company.

Kantar Philippines’ Worldpanel Division Client Manager Bea D. Coronel, on Friday, Sept. 1, presented during a virtual presser its Brand Footprint 2023, which shows the ranking of FMCG companies based on their Consumer Reach Points (CRP).

The analysis seeks to unravel the penetration or the proportion of households that buy the brand, and the consumers’ choice or the total number of times the brand is chosen by Filipinos within a 12-month period.

As shown in this year’s Brand Footprint, from October 2021-October 2022 data covering 5,000 households, Lucky Me ranks No. 1 FMCG brand picked by Filipinos in 2022, the same as last year’s report.

Based on Kantar’s data, 98.9 percent of neighborhood households—or about 27.4 million shoppers—bought Lucky Me. The brand was chosen by these households 911 million times annually, or 33 times on average.

Coffee brands Nescafé (688 CRP) and Kopiko (627 CRP) are in second and third place, respectively. With 585 CRP, Silver Swan, a staple in Filipino cooking, is ranked fourth. Coca-Cola, a soft drink company, received 488 CRP to place in the top 5.

Coronel claims that the Brand Footprint tries to record a crucial time when Filipinos make their FMCG purchases.

“Filipinos have been spending more for their FMCG needs, especially in 2022 when we came out of the pandemic and our lifestyles began to shift and return to normalcy. There is now a higher demand for FMCG and companies must be able to capitalize on that split second when shoppers decide and choose one brand over another. At Kantar, we capture that powerful moment using the CRP measure in order to reveal which brands are consistently winning their way into the shopping baskets of Filipinos,” said Coronel.

Other F&B goods that made it to the list are Bear Brand (6th with 482 CRP), Maggi (8th with 431 CRP), Great Taste (9th with 424 CRP), and Datu Puti (10thwith 406 CRP). While Surf earned 467 CRP in seventh position, the only home care brand to break into the Top 10.

Coronel also showed that 61 percent of the nation’s brands are expanding despite inflationary pressures. The majority of companies, from small brands to super brands, are gaining high penetration in Filipino households. Interestingly, 57 percent of small brands—those that reach fewer than 10 percent of Filipino consumers—have seen growth in the previous 12 months.

“When brands grow bigger, they are likely to increase in reach through a combination of penetration and frequency… When combined, these two factors allow brands to win and gain more loyal shoppers,” she interpreted.

In 2022, 96 percent of winning brands expanded through wider penetration, with 57 percent through higher penetration and purchase frequency, and 38 percent through penetration alone.

Kantar further provided a list of four growth levers that companies may utilize to keep their penetration rates stable despite an expanding population. This includes more presence (increasing the number of locations close to customers), more categories (expanding the range of available products to draw customers), innovation (adding new variants to meet changing customer needs), and more moments (continuing to be relevant and accessible at as many points of consumption as possible).

She also noted that FMCG companies gain competitive CRP and make the Top 10 Most Favored companies list of Kantar’s Brand Footprint report have more chances of dropping in Filipinos’ shopping baskets.

Original Article: https://mb.com.ph/2023/9/1/f-and-b-products-remain-filipinos-top-choice-kantar-s-2023-report

In recent times, the global economy has been confronted with the challenging issue of inflation. The significant impact of surging prices on basic and essential goods has been a growing concern for individuals, leading them to look for more affordable alternatives.

With this, EuroAsia Research Experts conducted a Price Survey to identify the cheapest supermarket retailer to help you make simple yet smarter decisions with your purchases.

The Price Survey is hereby guided by the following principles:

The following 74 items were surveyed, 71 of which are available at all retailers:

When making purchasing decisions, consumers often compare the prices of similar products to evaluate which option offers the best value for their money. It is certain that price serves as a fundamental basis for comparison among consumers.

In line with this, EuroAsia Research Experts gives you this week’s most affordable supermarket retailer.

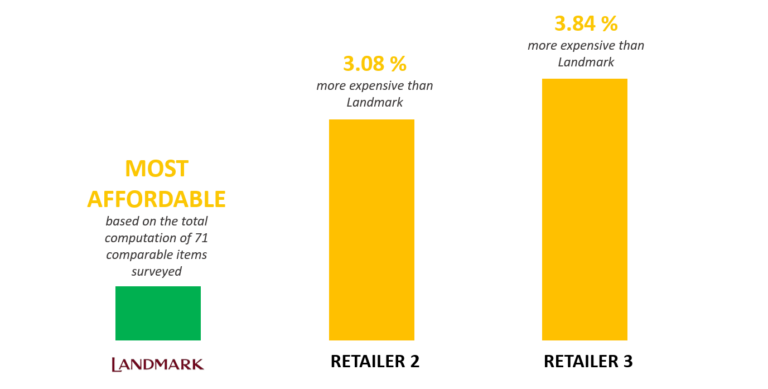

Landmark, known for its great brands, hard-to-find products, and competitively lower price tags on most items, was hailed as the most affordable supermarket among the other two retailers. Retailer 2 is 3.08% more expensive, followed closely by Retailer 3, which is 3.84% more expensive than Landmark.

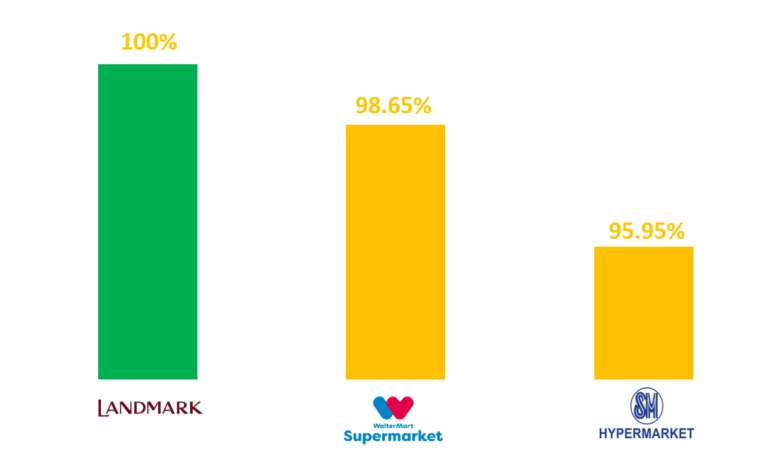

Landmark not only excelled in terms of pricing but also won in terms of product availability by having 100% of the 74 SKUs surveyed! Landmark is followed closely by WalterMart, with 98.65% of the 74 SKUs surveyed, and SM Hypermarket, with only 95.95% of the SKUs surveyed.

EuroAsia Research Expert is a valuable resource that offers a price survey, providing consumers with the latest insights from supermarkets and retailers. This information is designed to assist individuals in making well-informed purchasing decisions.

Whether you are looking to compare prices between different supermarkets or simply want to stay updated on the latest pricing information, EuroAsia Research Expert is here to help. So, the next time you are in need of guidance for your shopping needs, turn to EuroAsia Research Expert for the most up-to-date insights which will make you purchase with confidence.